3QFY2019 Result Update | Power

February 2, 2019

NTPC Ltd

BUY

CMP

`140

Performance Highlights

Target Price

`195

Investment Period

12 Months

(` cr)

3QFY19

2QFY19

% chg (qoq)

3QFY18

% chg (yoy)

Net revenue

24,120

22261

8.4

20774

16.1

Stock Info

EBITDA

6270

5592

12.1

5230

19.9

Sector

Power

EBITDA margin (%)

26.0

25.1

25.2

Market Cap (` cr)

115,560

PAT

2,385

2,426

(1.7)

2,361

1.0

Net Debt (` cr)

126,479

Source: Company, Angel Research

Beta

0 .6

52 Week High / Low

180/135

For 3QFY2019, the company posted robust sales growth of 16.1% yoy to end the

Avg. Daily Volum e

439,496

Face Value (`)

10

period at `24,120cr On the Operating front, EBITDA margins came in at 26.0% v/s

BSE Sensex

36,469

25.2% in 3QFY2018. However, inspite of the same PAT came in at `2,385cr v/s.

Nifty

10,894

`2,361cr in 3QFY2018, a rise of 1.0% yoy.; mainly on back of as higher working

Reuters Code

NTPC.BO

capital which impacted the company’s other income and rise in interest expenses.

Bloom berg Code

NTPC.IN

We maintain our Buy.

Shareholding Pattern (%)

Prom oters

58.9

Quarterly highlights: For 3QFY2019, the company posted robust sales growth of

MF / Banks / Indian Fls

27.2

16.1% yoy to end the period at `24,120cr. On an operational basis, gross generation

FII / NRIs / OCBs

11.7

grew 3.4% at ~70 billion units (BUs) whereas energy sold grew 3.1% YoY to 65.3 Bus.

Indian Public / Others

2 .2

PLFs of coal plants were at 77.7% vs. 76.9% in 3QFY18. Thus, higher realizations

(9.6% yoy rise) were key growth driver during the period. On the Operating front,

Abs .(%)

3m

1 yr

3 yr

Sensex

(0.2)

1 .6

46.9

EBITDA margins came in at 26.0% v/s 25.2% in 3QFY2018. However, inspite of the

NTPC

(17.1)

(17.1)

0 .1

same PAT came in at `2,385cr v/s. `2,361cr in 3QFY2018, a rise of 1.0% yoy.; mainly

on back of as higher working capital which impacted the company’s other income,

which dipped by 40% yoy. Interest cost rose 19.9% yoy to `1,277cr, as working

capital increased due to higher receivables. In addition, the tax outgo during the

3-year price chart

period was `794cr, a yoy growth of 235.6%.

200

Outlook and valuation: Over FY2018-20, the company is expected to post a CAGR

180

of 10.5% and 10.2% in the sales and net profit respectively. At current price, the

160

stock trades at 1.0xBV FY2019E; which implies a very low ~14-15% business ROE’s

140

and low growth prospects for the company over a long period.

Key financials (Consolidated)

120

Y/E March (` cr)

FY2017

FY2018E

FY2019E

FY2020E

100

Net sales

82,042

88,083

96,011

107,532

80

% chg

11.7

7.4

9.0

12.0

Net profit

10,749

10,526

10,938

12,779

% chg

(1.4)

(2.1)

3.9

16.8

Source: Company, Angel Research

EBITDA margin (%)

26.2

25.4

25.5

25.7

EPS (`)

13.0

12.8

13.3

15.5

P/E (x)

10.7

11.0

10.6

9.0

P/BV (x)

1.2

1.1

1.0

1.0

RoE (%)

11.3

10.5

10.2

11.0

7.4

6.5

6.6

7.2

Sarabjit kour Nangra

RoCE (%)

+91 22 3935 7800 Ext: 6806

EV/Sales (x)

2.8

2.8

2.7

2.2

EV/EBITDA (x)

10.8

11.0

10.5

8.7

Source: Company, Angel Research; Note: CMP as of February 1, 2019

Please refer to important disclosures at the end of this report

1

NTPC Ltd | 3QFY2019 Result Update

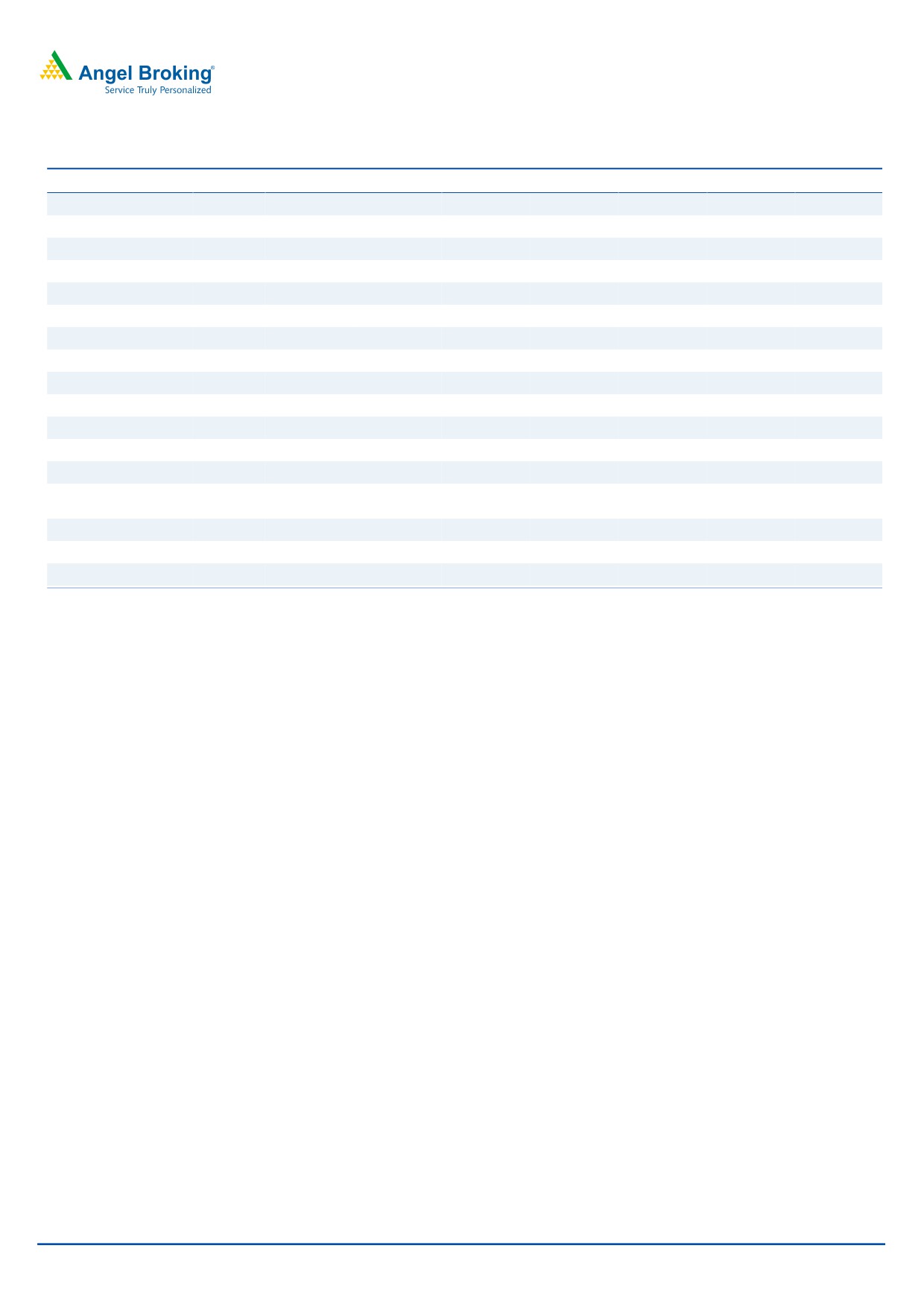

Exhibit 1: 3QFY2019 performance (Standalone)

Y/E March (` cr)

3QFY19

2QFY19 % chg (qoq)

3QFY18

% chg (yoy)

9MFY19

9MFY18

% chg(yoy)

Net sales

24,120

22,261

8.4

20,774

16.1

69,085

60,352

14.5

Other income

188

595

(68.5)

313

(40.1)

769

1560

(50.7)

Total income

24,308

22,856

6.4

21,088

15.3

69,854

61,912

12.8

Gross profit

8898

8775

1.4

7981

11.5

26578

23822

11.6

Gross margin (%)

36.9

39.4

38.4

38.5

39.5

Operating profit

6270

5592

12.1

5230

19.9

18127

15757

15.0

Operating margin (%)

26.0

25.1

25.2

26.2

26.1

Financial cost

1277

1294

(1.3)

1065

19.9

3791

2880

31.6

Depreciation

2001

1888

6.0

1881

6.4

5750

5164

11.3

PBT

3180

3005

5.8

2597

22.4

9355

9273

0.9

Provision for taxation

794

579

237

235.6

1956

1855

5.4

PAT Before Exc. And MI

2385

2426

(1.7)

2361

1.0

7400

7418

(0.2)

Minority

0

0

0

0

0

-

Exceptional

0

0

0

0

0

profit/(loss)

Reported PAT

2385

2426

(1.7)

2361

1.0

7400

7418

(0.2)

Adjusted PAT

2385

2426

(1.7)

2361

1.0

7400

7418

(0.2)

Adj. EPS (`)

2.89

2.94

2.86

8.97

9.00

Source: Company, Angel Research

Operational Highlights

Six stations clocked PLF > 85%; while three stations clocked >90% PLF.

Working capital increased due to higher dues/receivables from state

discoms and advance to Railways for preferential rake allotment.

Fixed charge u/recoveries came in at ~`280cr in 3QFY2019. Management

guided for a decline in u/recoveries to ~`750cr in FY2019 v/s ~`1035cr in

9MFY2019, given the improvement in coal availability and the restart of

Unchahar unit 6 (500MW).

Commercial capacity expanded

~323MW yoy to

51.7GW, given

decommissioning of Badarpur (705MW), partly offset by the acquisition

of Barauni (220MW).

Installed Capacity of the group expanded to 53.16GW, a yoy expansion of

~1.8GW. Including the decommissioning of Badarpur (705MW), the

expansion in capacity was around ~2.5GW.

FY2019 capacity addition target maintained at ~4.8GW.

February 2, 2019

2

NTPC Ltd | 3QFY2019 Result Update

Investment arguments

Electricity Sector; woes still hard to Ignore: Though government has allowed

private participation in the sector, private sector has not been able to dent the space;

given most of them are not profitable and have done heavy bidding. While the

demand is likely to improve over next 5 years and new supplies are moderating still

we believe that the PLF’s of the industry will rise moderately; with a downward risk.

Thus, we believe that while possibly the major negativity could be behind us, it is

unlikely that the industry will be out of woods soon.

NTPC; safe haven to take exposure; given its competitive advantages: NTPC is

the largest pan India power generator in the country, having significant market share

in terms of installed capacity as well has in terms of the electricity sold. Unlike its

private players, NTPC's projects operate under the regulated ROE model.CERC

regulations ensure that power generators enjoy a fixed return of 15.5 per cent, under

the regulated ROE model. Along with this NTPC is a cost competitive power producer,

this along with the AFS and strong backing of government; which keeps its cash flow

healthy and access to low cost funds, provides NTPC a safe player in the Industry

struggling with poor business economics. In addition, valuations at 1.0xBV FY2019,

factor in a low business ROE of 14-15% & low growth prospects.

Outlook & Valuation

Over FY2018-20, the company is expected to post a CAGR of 10.5% and 10.2% in the

sales and net profit respectively. Apart from the near term triggers, we believe that the

long term NTPC is well placed to tap the opportunity in the Industry; mainly on back

of the competitive advantage sit enjoy. At current price, the stock trades at 1.0xBV

FY2019E; which implies a very low ~14-15% business ROE’s and low growth prospects

for the company over a long period. On a very conservative basis, giving 1.5xBV to

the regulated book, the target price on the stock will work out to be `195.10-

year trailing P/BV multiple of the company has been at 1.7x.

Company Background

Government of India (GoI) incorporated NTPC in 1975 as a thermal power generation

company. Power generation and bulk sale of electricity forms NTPC's principal

business, and power is sold through long-term PPAs, mainly signed with state

distribution utilities. The company has installed capacity of 50.5GW (including joint

ventures and subsidiaries) as on March 31, 2017 represented around 15% of India’s

capacity and ~24% of the power produced. Coal-based capacities dominate the fuel

mix of NTPC group- of the total installed capacity around 85% capacity is coal-based,

while the balance is based on gas, hydro and renewable projects. The company has

undertaken backward and forward integration and has entered into related

businesses, such as consultancy, coal mining and power trading.

February 2, 2019

3

NTPC Ltd | 3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in

securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of

securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.

Disclosure of Interest Statement

NTPC Ltd

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 2, 2019

4